2020 is a year full of challenges for the global iron and steel industry- Demands for iron & steel have seen a sharp fall, and relevant manufacturers have been confronted with huge difficulties in their regular production and operation, resulting in a dramatic drop in worldwide iron and steel output. In the second half of this year, as the epidemic in China and other countries was brought under control, the industry is gradually picking up on increasing iron & steel demands and production.

China's Blast Furnace Utilization Rate in November Increased by 2.86% from the Same Period Last Year

Data tracked by CRU showed that due to the coronavirus pandemic and other related factors, a total of 72 blast furnaces worldwide were idled or banked up in 2020, involving a crude steel production capacity of 132 million tons(Mt). Enterprises that cut blast furnace output this year include ArcelorMittal S.A., Voestalpine AG in Australia, ThyssenKrupp AG, Salzgitter AG in Germany, Vallourec S.A. in France, UK LIBERTY Steel Group, SSAB in Sweden, United States Steel Corporation, AK Steel, Nucor Corporation, Stelco in Canada, Turkey’s Isdemir, Brazil’s Usiminas, Gerdau and CSN, Nippon Steel, JFE Steel, etc.

A report released on September 8 showed that due to the rebound in iron and steel demands and economic considerations, global steel manufacturers are currently restarting about 22 blast furnaces which were damped down or temporarily suspended resulted from the pneumonia epidemic, accounting for 34% of the total production capacity of affected blast furnaces. In view of the time constraints of the stuffy furnaces and the climbing demands for iron products, it is expected that most idle blast furnaces will be restarted before the end of 2020.

On another, China's pig iron output in October 2020 reached 76.171 million tons, up 9.4% compared with the same period a year earlier. From January to October 2020, China's total pig iron output was 741.699 million tons, a year-on-year increase of 4.3%.

A November survey of 247 steel mills in China showed that the utilization rate of blast furnaces achieved 86.46%, a year-on-year increase of 2.86%, and the rate of BF ironmaking capacity utilization was 91.64%, down 0.47% from the previous month and an increase of 7.08% y-o-y. And furthermore, the profitability rate of steel mills hit 92.64% y-o-y and m-o-m with the average daily molten iron output of 2,439,200 tons, a decrease of 12,600 tons from the previous month and an increase of 188,400 tons over the same period a year earlier.

World Crude Steel Production in October 2020 Achieved 7.0% Increase from October 2019

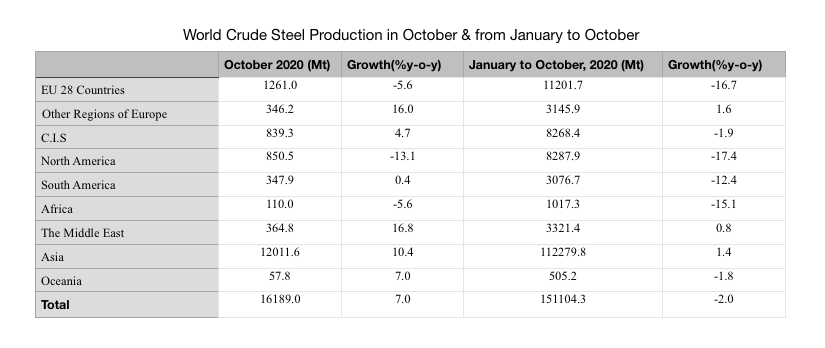

Statistics show that in October 2020, the total crude steel production of 64 countries and regions included rose to 161.9 million tons, up 7.0% from the same period last year and an increase of 2.6% compared with 157.8 million tons in September, which is the third consecutive month of year-on-year growth. In October, except for the decline in the EU 28 countries, North America and Africa, the crude steel output increased year-on-year in all other regions, among which Asia, the Middle East and the rest regions of Europe witnessed an increase of more than 10%. This proves that world steel manufacturing is gradually getting out of the negative effects.

In October, Asia’s crude steel production had a 10.4% year-on-year growth to 120.12 million tons, among which China produced 92.2 million tons of crude steel, a year-on-year increase of 12.7%. India produced 9.06 million tons, a slight increase of 0.9% on October 2019 while Japan’s crude steel production decreased by 11.7% year-on-year to 7.2 million tons, but up 11.0% on last month. With the rising demand for the manufactured products, Japan's crude steel production increased for the 4th consecutive month after hitting a yearly low in June this year. South Korea produced 5.86 million tons of crude steel in October, down 1.8% y-o-y.

In October, crude steel production of the EU’s 28 countries decreased by 5.6% year-on-year to 12.61 million tons, where the biggest steel manufacturing country, Germany, produced 3.42 million tons of crude steel, up 3.1% year-on-year. In North America, crude steel output had a year-on-year decrease of 13.1% to 8.51 million tons, of which US production fell 15.3% year-on-year to 6.14 million tons. Crude steel production in South America had a 0.4% mild year-on-year increase to 3.48 million tons, of which Brazil produced 2.78 million tons of crude steel, an increase of 3.5% from one year earlier. The C.I.S produced 8.39 million tons of crude steel, a growth of 4.7% year-on-year, of which Russian output was estimated to be 6.05 million tons, a 4.3% year-on-year growth. Crude steel production in the Middle East leaped 16.8% than the previous year to 3.65 million tons, mainly driven by Iran’s crude steel growth. Iran’s crude steel output in October was estimated to be 2.66 million tons, a significant increase of 27.9% over last year. In addition, Turkey produced 3.21 million tons of crude steel, up 19.4% on October 2019.

From January to October 2020, global crude steel output was 1.511 billion tons, a 2.0% drop from last year. In the first 11 months, crude steel production in Asia was 1.1228 billion tons, up 1.4% y-o-y, where China's crude steel production was 873.9 million tons, an increase of 5.5% year-on-year while India's was 79.68 million tons, a year-on-year drop of 14.4%, Japan's was 68.41 million tons, down 18.4% y-o-y and South Korea's was 55.04 million tons, a decrease of 7.7% from the same period last year.

From January to October, the EU's crude steel production was 112 million tons, down 16.7% from last year. The crude steel output in North America was 82.88 million tons, down 17.4% year-on-year. And the output in South America was 30.77 million tons, down 12.4% y-o-y and in the C.I.S was 82.68 million tons, a year-on-year decrease of 1.9%.

See Table below for the crude steel production across the world in October and from January to October:

With the gradual resumption of iron and steel production from it getting rid of pandemic influence, the world iron & steel industry has been progressing in an orderly way. The manufacturing and management have maintained a mild growing tendency, which has also promoted the further development of upstream and downstream industries. Although 2020 is critically challenging, PKU Pioneer, through unremitting efforts and flexible strategic adjustments, has equipped over 10 domestic and foreign iron & steel manufacturers with VPSA and PSA oxygen plants. Oxygen supply is an indispensable link in the steelmaking and ironmaking processes, thanks to its prominent advantages of low investment & power consumption (0.32±0.01kWh/Nm3), short construction period, fast start-up and shut-down and high automation, matched with the oxygen-rich solutions highly attached to customer's demands, the VPSA & PSA oxygen units of PKU PIONEER has been highly recognized by our end-users by solving the practical issues like high oxygen device setting-up cost, unstable operation, etc. and helping them get over difficulties and achieve win-win this year.

(Edited by PKU PIONEER)

2020-12-10

2020-12-10